Bassanese Bites: Nvidia earnings to highlight week ahead – 17 November 2025

US equities were flat overall last week, with optimism around the re-opening of the federal government tempered by ongoing valuations concerns and trepidation ahead of the release of delayed economic data.

Global week in review: Washington re-opens!

Last week started positively, with news of a deal in Washington to allow the re-opening of the US government. The compromise deal ‘kicked the can down the road’ on the contentious issue of US healthcare insurance subsidies, but at least allowed planes back in the sky and food support for those most in need. This produced a series of positive news events, with the deal first passing the Senate, then the House of Representatives and finally signed into law by President Trump.

Tempering this positive news were lingering concerns over equity valuations and growing discussion over whether the AI boom was turning into a bubble. Also dampening investor enthusiasm were a series of Fed speakers all generally pushing back on a December rate cut – markets now see it as only a 50-50 proposition. Last but not least was trepidation over what official economic data will tell us about the health of the US economy, now that official figures will start being released again.

On perhaps a positive note, President Trump announced cuts to tariffs on various foods, effectively acknowledging – without admitting it openly – that they’ve had some effect in raising prices. He also struck a deal with Switzerland, lowering its tariff from 39% to 15%.

Global week ahead: Nvidia and payrolls

We’ll get important updates on two key market concerns this week: the state of US corporate earnings and the economy. Nvidia, the major supplier of computer chips in today’s AI boom and now the world’s most valuable company, will release earnings on Thursday morning Australia time. With growing talk of an AI bubble, the market will be seeking reassurance that demand for its chips and its profitability remain strong.

On Thursday morning US time, we also get the belated release of the US September payrolls report, amid heightened concerns that the US labour market is slowing. Last week’s ADP payrolls report suggested employment continued to grow in October, albeit the pace of growth had slowed from earlier this year. For markets, a weak payrolls report could be mixed news as, while it poses downside economic risks, it might also increase the chances of a Fed rate cut next month.

Of some concern are estimates suggesting that AI investment spending has accounted for a big chunk of US economic growth so far this year. Were it not for the AI boom, tariff mayhem and immigration cuts might have left the overall economy looking a lot worse.

Minutes from the October Fed meeting – at which rates were cut a further 0.25% – will also be released.

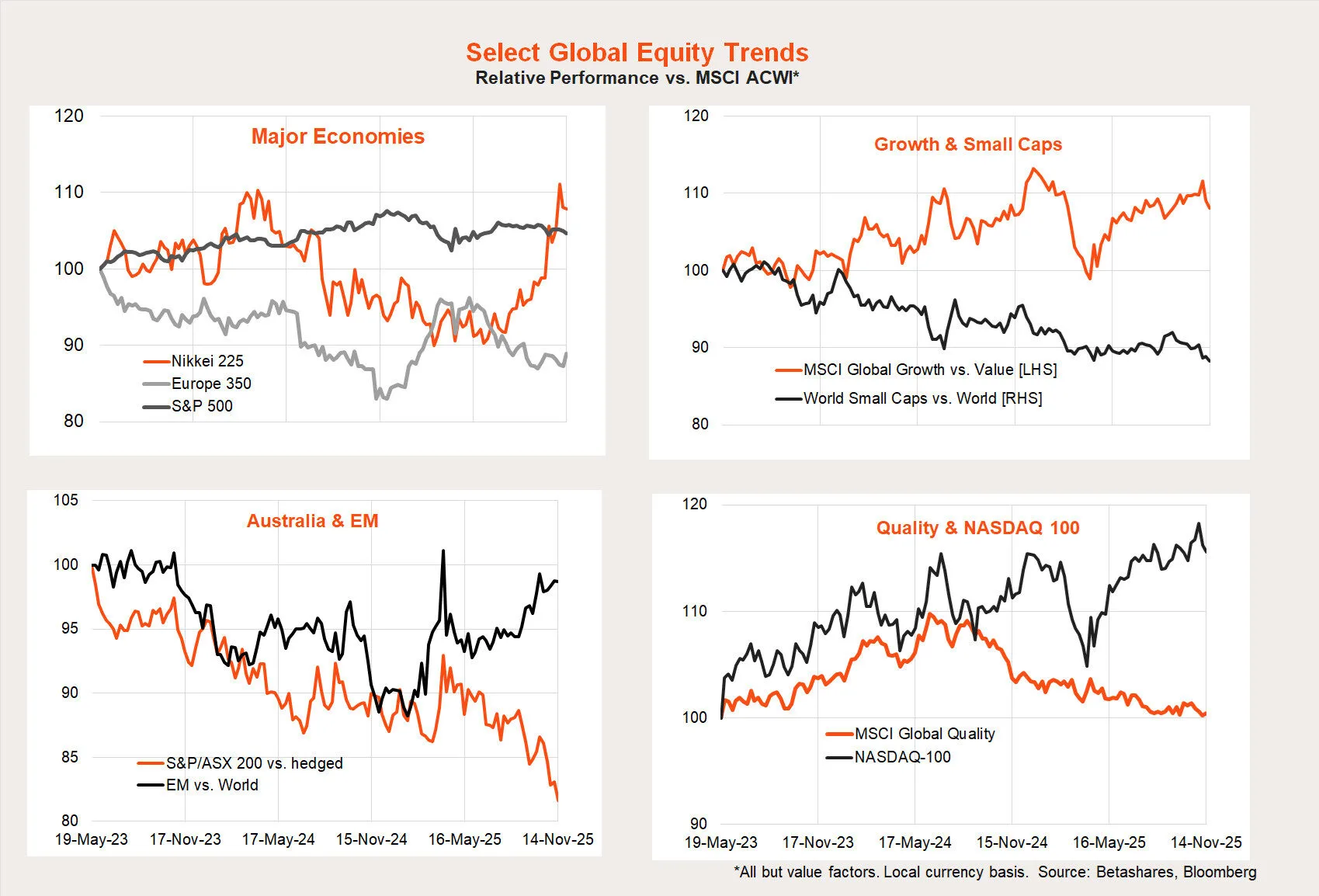

Global equity trends

Equity returns were fairly subdued across the globe last week, although among the markets we track Europe fared best and Australia the worst. The NASDAQ-100 slipped only marginally, following its 3% decline in the previous week.

Underlying trends remain as follows: the NASDAQ-100 has still performed relatively well of late. We’ve also seen stronger relative performance in Japan and emerging markets, although not Europe or (sadly) Australia.

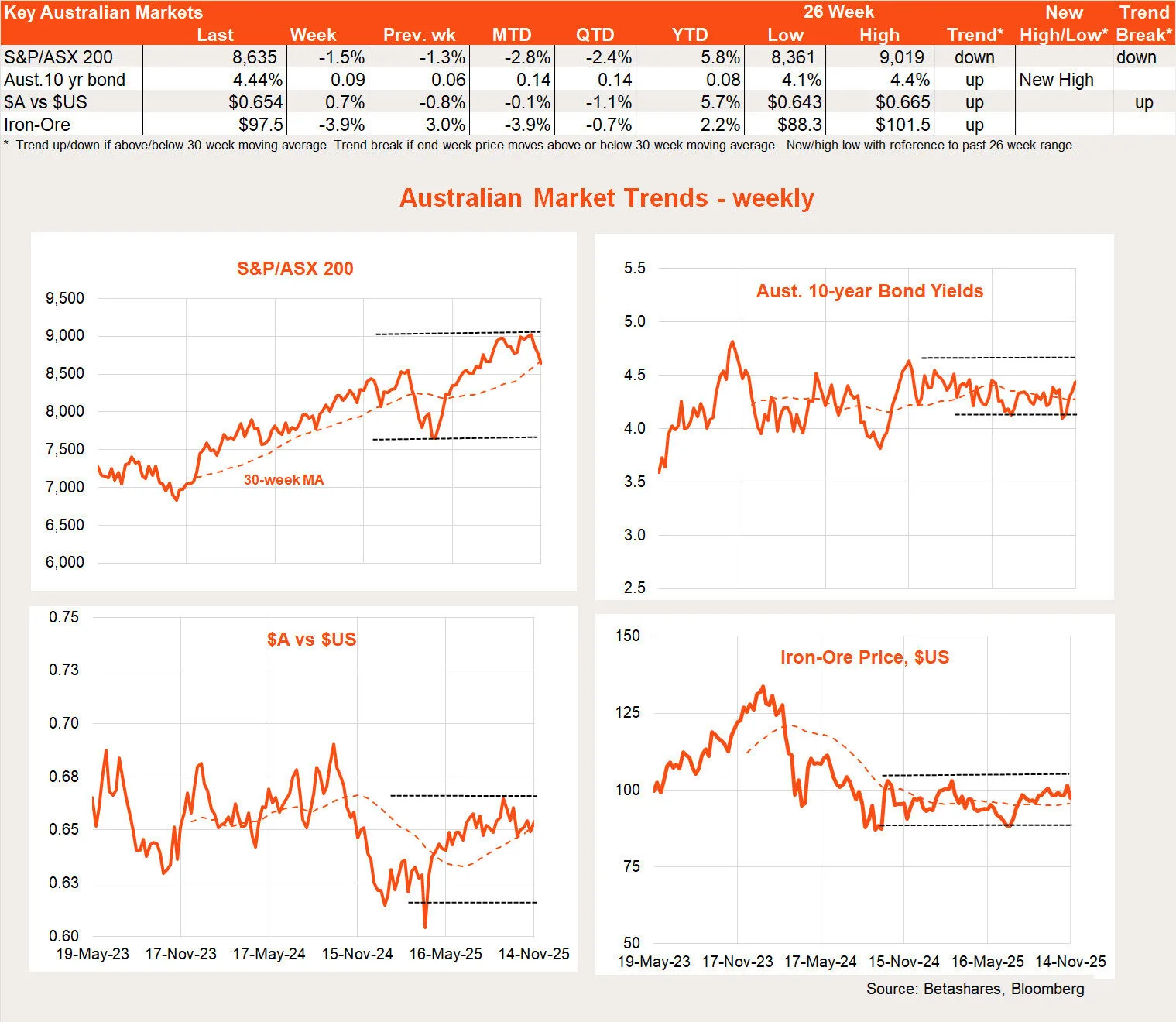

Australian week in review: RBA holds as expected

The local market underperformed again last week with both economic data and RBA commentary all suggesting little prospect of a year-end rate cut.

The week began on a dour note, with a speech by RBA Deputy Governor Andrew Hauser noting that the current rate cut cycle is taking place against the backdrop of lower-than-usual economic spare capacity – suggesting rate cuts might also not be as deep as usual.

Of course, all this depends on the trend in inflation. If it turns out that underlying inflation does fall to the middle of the RBA’s 2-3% target band next year (as I expect), academic discussion of output gaps will be moot and the RBA would still likely ease policy rates back to a more neutral setting closer to 3%.

Local economic data was also fairly upbeat, with a surprise 12% bounce in the Westpac measure of consumer confidence (likely reflecting stronger house prices) and a further modest lift in the NAB survey measure of business activity. Both business and consumer confidence are now around their long-run average levels.

To cap off the week, October employment rose a stronger than expected 42k, with the unemployment rate edging back down to 4.3% from 4.5%.

Australian week ahead: Labour market test

Given local discussion of output gaps and labour market tightness, Wednesday’s Q3 wage price index report will be of interest – the market is expecting another fairly mild 0.8% increase. Modest wage growth argues against the idea that the labour market is too tight, although some might say it reflects poor productivity growth and that unit labour cost inflation remains firm.

Also of note tomorrow will be minutes from the RBA’s recent policy meeting, although we’re unlikely to learn much new on the Bank’s thinking. RBA Assistant Governor Sarah Hunter will also share her views on Thursday.

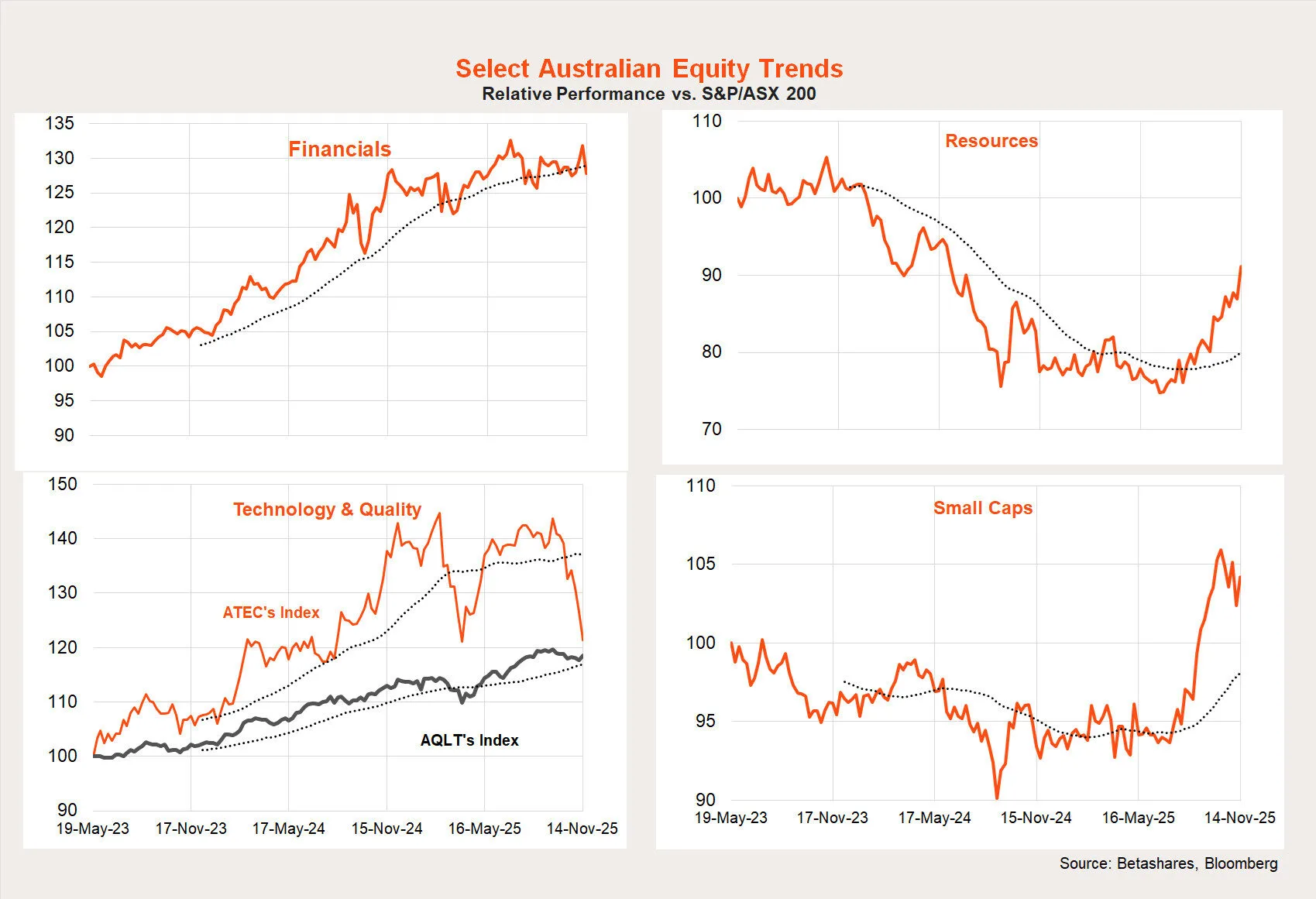

Australian equity trends

Dampened rate cut hopes have generally hurt high-beta local equity themes of late such as technology and small caps. Last week technology suffered further, although small caps managed to post a small gain.

In the large cap space, resources are going from strength to strength with another solid gain last week while financials and property fell back.