Bassanese Bites: Tacos and Fed puts August 12 2025

Global week in review

Global equities bounced back last week despite another weak US economic report, as investors ‘bought the dip’ following the previous week’s sell-off.

Markets place faith in Fed and Trump put

Although the knee-jerk reaction to the previous Friday’s weak US employment report was to sell equities, investors were keen to buy the dip come Monday morning. Helping support stocks last week were dovish comments from various voting Fed members, who expressed some concern over the weak payrolls report and talked up the prospect of rate cuts. Markets are now attaching an 88% chance to a September Fed rate cut.

Equities did briefly weaken last week in the face of a softer-than-expected US ISM Services PMI report. The headline services index came in at 50.1, from 50.8 and below the market expectation of a bounce to 51.5. The details were even worse, with the employment index falling further to 46.4 while the prices paid index leapt to 69.9.

This highlights the fact that the effects of tariffs are coming through and the near-term result will look stagflationary (weaker growth and higher inflation) due to the significant increases in import taxes.

That said, the market’s ongoing resilience to tariff concerns seems to have emboldened President Trump. Last week he announced tariffs on India would rise to 50% (due to its large purchases of Russian oil) – even though the US continues to import significant volumes from Russia at the same time. He also flagged higher tariffs on drugs and computer chips could come sometime soon. Markets did take kindly to Apple’s announcement that it would invest another US$100 billion in the US, on top of the US$500 billion promised earlier this year.

Ultimately, with tariff effects still only trickling into US hard economic data, markets continue to place faith in the Fed cutting rates to help the economy if need be. Markets also remain hopeful that Trump might “chicken out” on his aggressive tariff campaign if the economic data turns a lot worse. The problem is that the data will need to weaken significantly before the TACO trade comes back into effect.

Global week ahead: US July CPI

We’ll likely get more evidence of tariff effects coming through this week with the US July consumer price index (CPI) report on Tuesday (US time). Core prices are expected to lift 0.3%, which would push up annual core inflation to 3.0%.

This is still much too high for the Fed to justify cutting interest rates anytime soon, even if the labour market appears to be weakening and some Fed members are angling to win Trump’s favour.

Global sharemarket trends

As has been noted here previously, the US/technology/growth/large cap outperformance trend appears to have largely resumed with the market rebounding since early April.

Europe/Australia/value has underperformed over this period, whereas Japan and Small Cap relative performance has tracked sideways. Of some note, emerging markets have given back only part of their outperformance from earlier this year and have been holding up reasonably well since early June. This has likely been helped by persistent weakness in the US dollar in recent months despite the rebound in US equity outperformance.

Australian week in review

There was little major local economic data last week, although the ANZ-Indeed Jobs Ads Index dipped a reassuringly small 1% in July to remain in the broad sideways range that has been evident since mid-2024. This provides a counterpoint to concerns of major labour market weakening evident from the past two official employment reports.

Australian week ahead

We’ll get an update on the employment situation with the July employment report on Thursday. Markets anticipate a 25k bounce in employment as a counter to the previous two weak monthly reports, which would see the unemployment rate dip back to 4.2% from 4.3%. Such a result would suggest the labour market is gradually easing.

Of course, the local highlight this week will be tomorrow’s RBA August policy meeting. Markets – and myself – are fairly convinced the RBA will cut interest rates by 25 basis points to 3.6%. My base case remains that the RBA is in no hurry to cut rates and the follow-up rate cut – barring a major growth scare – won’t come until November.

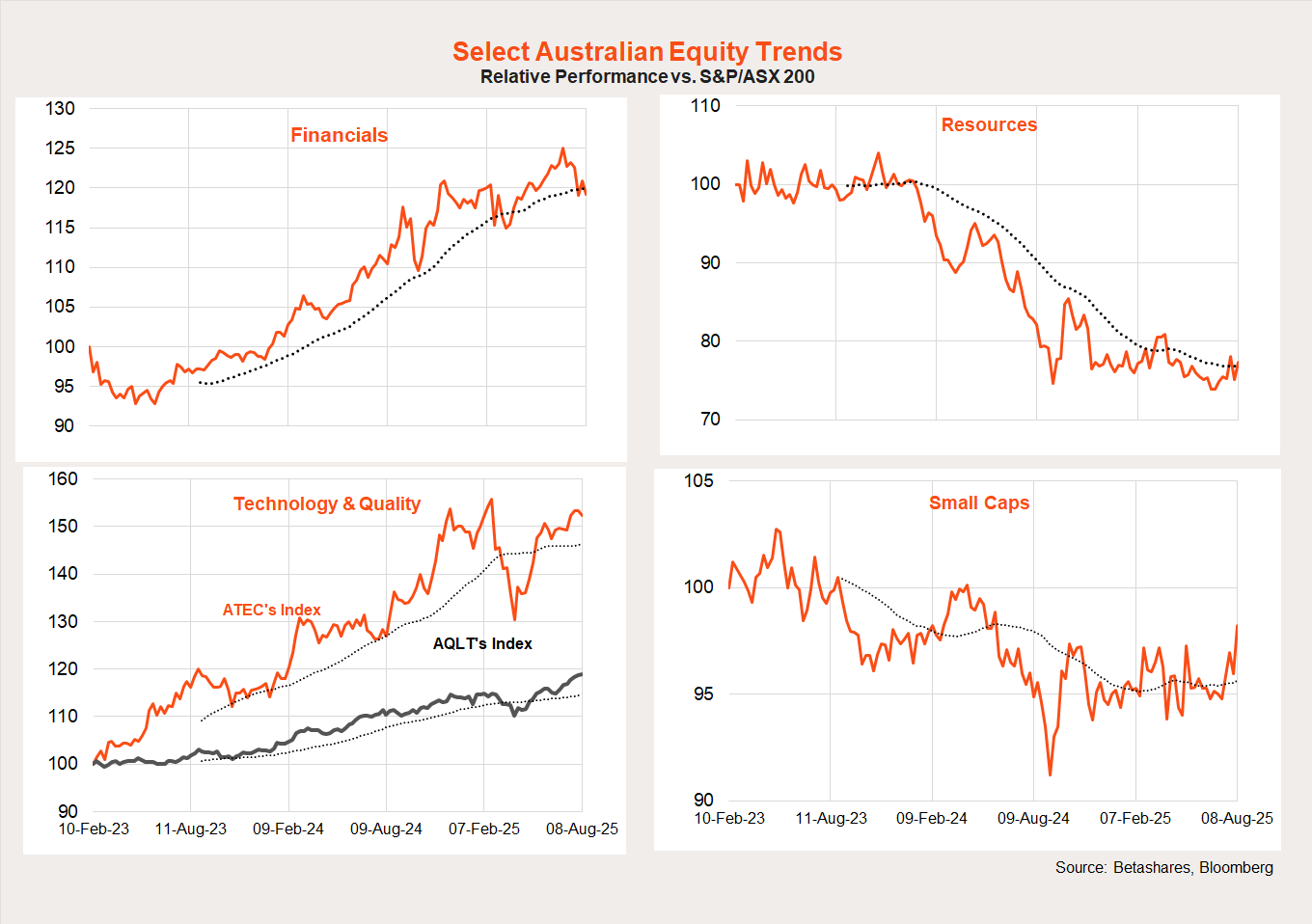

Australian sharemarket trends

In terms of local equity trends, a partial unwinding of financial sector outperformance has been evident since late June, coinciding with a bottoming out of resource sector underperformance and a bounce in (admittedly volatile) small cap performance. Quality and technology stocks continue to perform well.